COVID-19 has presented unprecedented challenges to markets, governments, businesses and individuals. Countries around the world are facing the social, financial and economic consequences of this health crisis. Arab Central Banks position themselves to lead the digital transformation of finance in support of the social and economic recovery.

With the 2020 Fintech Innovation Lab, hosted and organized by the Arab Monetary Fund (AMF) and GIZ, FIARI took the network activities to counteract the COVID-19 pandemic to the next level. The Fintech Innovation Lab provided a platform to exchange knowledge about innovative regulatory approaches to Fintech, about guidelines and experiences for drafting Fintech strategies, and thus to awareness about digitalized financial systems in support of socio-economic conditions during and beyond the pandemic.

Technology will help financial institutions and markets to transform digitally and ultimately bring forth such inclusive services which can strengthen people and businesses in their resilience and economic capacity. Strategies are needed to create the ecosystems and innovation-friendly regulatory frameworks that enable safe fintech and drive the digital transformation of finance.

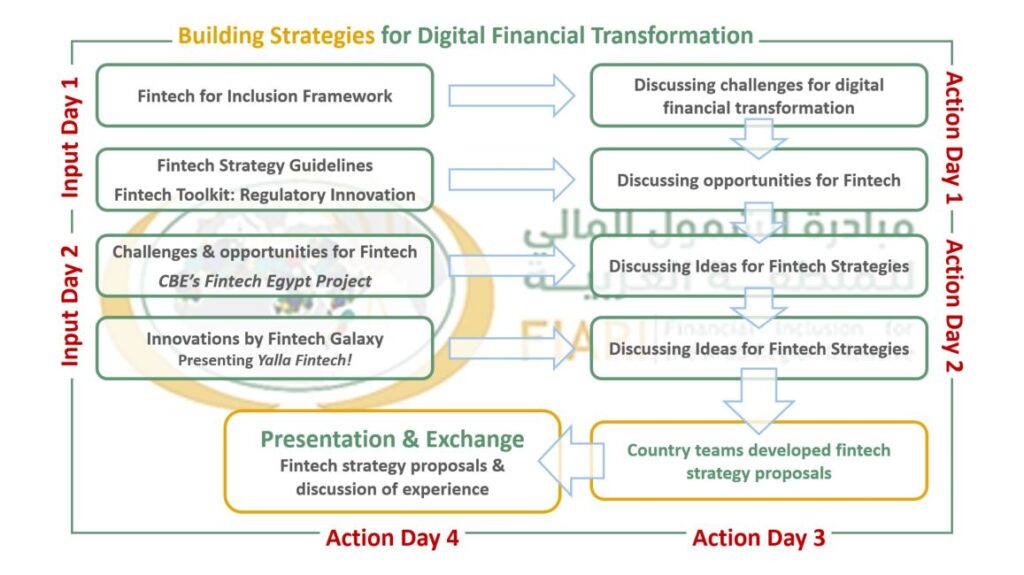

The Fintech Innovation Lab was conducted as a 4-day digital workshop with highly interactive and creative sessions. Leading experts provided the foundations for key enablers of resilient and inclusive Fintech. Professionals from leading financial authorities, such as from Central Bank of Egypt, shared and exchanged on good practice in building and promoting an enabling ecosystem for fintech innovations and digital financial services to emerge.

All 80 members from 17 Arab countries engaged in breakout groups actively in hands-on exercises to pin down challenges for developing fintech markets and to work out priority actions for digitalizing their financial systems. The simplified digital customer on-boarding and eKYC, interoperable payments systems and open banking infrastructure, financial capabilities on demand side, and e-Government or Govtech emerged as the main common issues.

Through the mixture of pre-recorded expert webinars, live discussions, pitches by innovation leaders, and the discussion across institutions and countries, the foundation was gradually laid for the third day of the Fintech Innovation Lab: 17 country teams went back offline to develop in country teams fintech strategy proposals for strengthening ecosystems and regulatory approaches towards digital financial systems.

The Fintech Innovation Lab culminated in 17 country teams pitching their fintech strategy proposals followed by an exchange of views from country perspectives.

The pandemic revealed how important it is that all levels of society have access to digital financial services.

The Fintech Innovation Lab empowered policymakers and regulators in actively driving forward the digitalization of Arab financial systems in a strategic and safe manner: a journey that Central Bank Governors of the FIARI network have collectively decided to embark on.

By Sebastian Kausemann & Atilla Yücel