Having attended last year’s Dead Sea policy event about Financial Inclusion and Employment in the MENA co-hosted by CBJ, AMF and GIZ, Simon Bell, the Global Lead for SME Finance at the World Bank, recaps the region’s most severe financial access gaps. Addressing these will impact people’s occupational and economic perspectives.

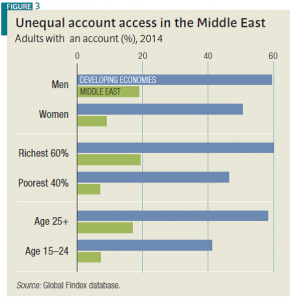

According to the 2014 Global Findex survey, only 14 percent of the population in the Middle East has an account at a financial institution or with a mobile money service provider compared to 62% of adults worldwide. Gaps in financial inclusion are particularly large for the youth, women, and poorer adults.

First, the majority of the people in the MENA is below the age of 30. However, “young adults are almost totally excluded from the financial system; only about 8% of 15-24 year-olds have an account” compared to 17 percent of adults at the age of 25 or above.

Second, while only 19 percent of men in the MENA are financially included, this share is even smaller for women and has been stagnating (9 percent; Global Findex). “Because levels are fairly low overall, this gender gap seems to take second order priority,” as Mayada El-Zoghbi puts it in a recent CGAP blog post. The region however has the largest gender gap worldwide in relative terms. On average, women in the Arab region are half as likely as men to have an account. The gap is significant even in the more advanced economies. Recent research by IFC suggests that financial inclusion of women is not only disturbing in terms of access. It is also discriminating quality-wise: women business owners, for example, receive loans that are smaller, shorter, and more expensive.

Third, a similar pattern holds true across income groups in the region. “Rich adults in the Middle East are more than twice as likely as poor adults to have an account,” according to a recent Findex focus note. The MENA has the worldwide biggest income gap in relative terms. Behind these gaps to financial inclusion costs play an important role. People mostly cited lack of enough money as the barrier to account ownership (77 percent), while 30 percent of people find accounts too expensive.

As has been evident at last year’s regional financial inclusion conference, the Arab world faces a renewed momentum in the space of financial inclusion of people and businesses. Building on that and the above barriers, the GIZ MFMR programme supports Palestinian, Jordanian and Egyptian policy makers, supervisors and other financial sector stakeholders in multifold ways:

- It facilitates national policy processes for financial inclusion that ensure concerted efforts at government and market level within priority areas ranging from microfinance to SME finance – from payments to savings, bolstered bynew financial technologies that will increase outreach and bring down costs

- It supports the conduct of demand and supply side analyses of financial sectors to determine patterns of financial access and usage by gender, age and income groups and thus to inform the design of strategies for effectively closing financial inclusion gaps

- It fosters peer-learning and exchange between financial sector policy-makers and experts. The GIZ MFMR programme joins hands with CBJ and AMF for this year’s regional conference about policies and strategies for “Advancing Women’s Financial Inclusion in the Arab World” scheduled for November 22-23, 2016.

by Atilla Yuecel