An important milestone towards Fintech promotion for financial inclusion: PMA opens its doors for innovators to test innovative solutions in their newly launched regulatory sandbox.

The sandbox offers local and international innovators the opportunity to test their banking and payments Fintech solutions in an experimental environment under the supervision of the Palestine Monetary Authority (PMA). It offers a safe testing ground for new financial services, back-office solutions for the financial sector or innovative business models, as well as an enhanced and supportive environment under real market conditions. This is a significant contribution to boost the growth of the Palestinian Fintech sector, an important tool to support efforts for financial inclusivity and economic growth and improved digital financial services offered to Palestinians.

This major milestone by the PMA to create an enabling environment for Fintech and innovative regulatory initiatives has been supported by GIZ’s “Alternative Approaches to Financial Inclusion of SME” (A-FIN) project. Marking a turning point in the methodology of PMA’s work by adopting and promoting Fintech innovation and creativity, the sandbox facilitates increased engagement between the regulator and Fintech firms. PMA supports applicants with guidance and oversight, as well as enabling them to overcome legislative and legal obstacles.

Watch the launch video here in Arabic

Cooperating and working in partnership with the private sector in all fields, specifically with business accelerators and incubators is of significance for successfully building a pipeline of Fintech solutions applying to the sandbox. Therefore, various stakeholders and representatives of the banking, financial, economic and technological sectors, innovators, incubators and accelerators as well as media attended the launching ceremony.

The general framework of the regulatory sandbox was developed with their contribution through the Fintech Taskforce, which was established in 2020 as a public-private dialogue format. Palestinian incubators highlighted during the launch how the sandbox helps innovators to overcome obstacles they face during the product development phase.

Majd Khalifeh, Chief Executive Officer of Flow Accelerator, stated that “market validation and value delivery to customers for early stage Fintech startups is critical in general and in Palestine in particular.” She continued that “one of the key points for increasing the number of successful launches of Fintech solutions is to provide a structured simulative environment and the necessary resources through the PMA’s Sandbox to test the functionality of an innovative solution and accordingly iterate and build a compelling final product.” She and two other incubators also presented the existing eligible Palestinian Fintech initiatives.

Watch the explanatory video about the Sandbox in Arabic here

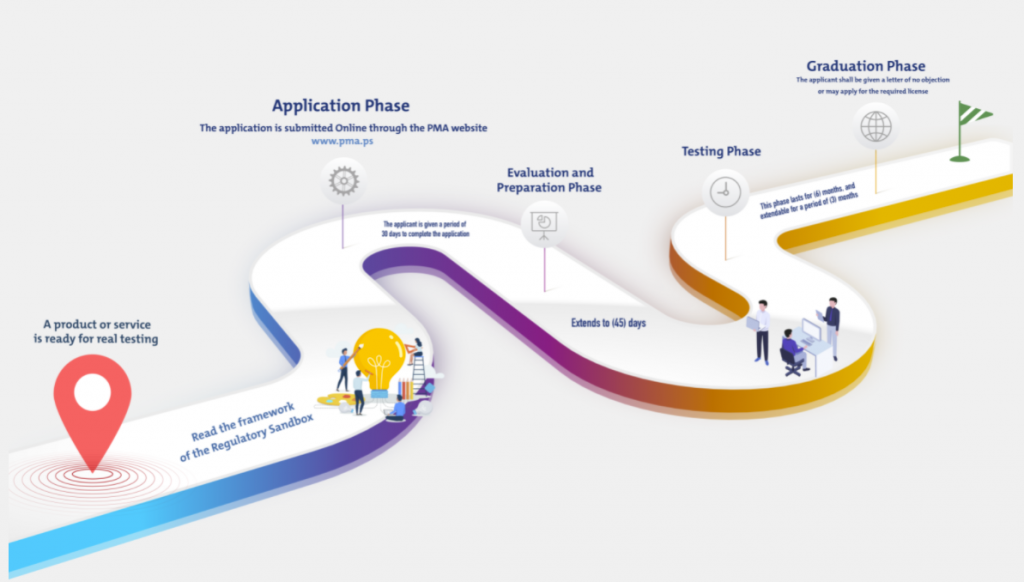

Local and global companies are encouraged to submit their application online through PMA’s website to test their financial innovation for future launch. If all eligibility criteria are fulfilled PMA’s Sandbox committee will evaluate the applicant’s solution. After a successful testing, the applicant will graduate from the sandbox by either receiving a no objection letter in the absence of sufficient instructions or may apply for the required license. Developing evidence-based policy in case of lacking regulatory rules is what PMA will work on after the graduation phase.

Aiming to foster market development through engagement with market participants and advancing financial inclusion is what PMA strives to achieve through its innovative regulatory initiatives. The regulatory sandbox is a big step to show that the regulator is open for new financial services and business models to get tested in the Palestinian Territories.

By Deborah Rammrath

You can find all information about the Sandbox here, have a look into its regulatory framework & read the press release here in Arabic.