As in other emerging markets access to finance remains a major barrier for around half of the 300,000 women-owned small and medium-sized enterprises in the MENA region. Addressing the funding gap for these businesses requires bold actions at all levels.

According to the IFC Enterprise Finance Gap Database, an estimated USD 260-320 billion in credit demand by women-owned small and medium-sized enterprises (SMEs) in emerging markets is unmet every year. In the MENA region, access to finance remains a major barrier for around half of the 300,000 female-owned MSMEs. The estimated credit demand is at USD 72 billion per year, according to the same report.

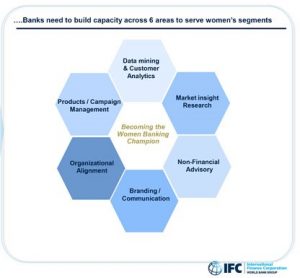

Manar Korayem, Women Banking Champions Program Lead, Financial Institutions Group, IFC EMENA, pointed out that there is a missed business opportunity: “banks do not have specific value propositions for women entrepreneurs and professionals”. Banks and financial institutions need to listen to the female market segment needs and integrate them into their existing business models, Korayem adds. Access to networks, access to markets, access to finance are some of the key challenges experienced by women-owned enterprises as showcased in this short video. Though the video shares examples of Women Entrepreneurs from Egypt, yet such challenges limit women potential across different markets. IFC’s experience with 42 banks around the world to build profitable business lines for the women’s market segment shows that there are six areas where banks and financial institutions may need to build capacity in order to effectively serve the women’s segment as per the following graph.

Manar Korayem, Women Banking Champions Program Lead, Financial Institutions Group, IFC EMENA, pointed out that there is a missed business opportunity: “banks do not have specific value propositions for women entrepreneurs and professionals”. Banks and financial institutions need to listen to the female market segment needs and integrate them into their existing business models, Korayem adds. Access to networks, access to markets, access to finance are some of the key challenges experienced by women-owned enterprises as showcased in this short video. Though the video shares examples of Women Entrepreneurs from Egypt, yet such challenges limit women potential across different markets. IFC’s experience with 42 banks around the world to build profitable business lines for the women’s market segment shows that there are six areas where banks and financial institutions may need to build capacity in order to effectively serve the women’s segment as per the following graph.

Among the banks in the region that successfully serve the women’s market, BLC Bank in Lebanon has a dedicated Women’s Empowerment (WE) Initiative, and Bank al Etihad in Jordan launched a holistic value proposition for women under the brand Shorouq.

“Women’s financial behavior makes them very attractive to banks”, points out Inez Murray, CEO of Global Banking Alliance for Women (GBA), a global consortium of financial institutions dedicated to supporting banks as they capture the opportunity of the women’s market. “Women are great savers, prudent borrowers, loyal customers, and purchase more products on average compared to men”, Murray explains. Both BLC Bank in Lebanon and Bank al Etihad benefited from the GBA membership. The alliance exposed them to innovative banking solutions for women from around the world.

“Women’s financial behavior makes them very attractive to banks”, points out Inez Murray, CEO of Global Banking Alliance for Women (GBA), a global consortium of financial institutions dedicated to supporting banks as they capture the opportunity of the women’s market. “Women are great savers, prudent borrowers, loyal customers, and purchase more products on average compared to men”, Murray explains. Both BLC Bank in Lebanon and Bank al Etihad benefited from the GBA membership. The alliance exposed them to innovative banking solutions for women from around the world.

Advancing the financial inclusion of women requires stakeholder engagement at policy, market and client levels. “We all need to work on a more inclusive legislative framework, on challenging prevailing social norms, financial institutions need to re-examine how they bank on women, and individual women need to learn more about finances – only then attitudes will change and with them more inclusion will be achieved”, Murray concludes.

Read the Arabic version here

By Miranda Beshara, the Arabic Microfinance Gateway

This blog post is brought to you by GIZ and the Arabic Microfinance Gateway under their Outreach Partnership for the Regional Policy Forum on Advancing Women’s Financial Inclusion in the Arab World. The event was hosted by the Central Bank of Jordan, the Arab Monetary Fund, and GIZ from November 22-23, 2016 at the Dead Sea, Jordan with the support of AFI, the European Union, CGAP, and New Faces New Voices.