Levering the digital age and the “new normal”, GIZ in Palestine is ready to build upon financial inclusion efforts and support financial innovation that holds promise to make financial services more appropriate, affordable and accessible for all Palestinians.

Technology in Finance (Fintech) has been a global game changer when it comes to how fast, efficient and cheap financial services can be provided. Fintech has the potential to reach low-income households and small-and medium-sized enterprises (SMEs), who are often challenged to save, invest and protect themselves against economic risks. Especially in Palestine, where unemployment rates are high and 80% of the labor force is employed by SMEs it is important to enable the access to suitable financial products so jobs can be sustained and created.[1] With this in mind, GIZ’s new project “Alternative Approaches to Financial Inclusion of SME (A-FIN)” arrived in Palestine in January 2020 with one goal: to make Fintech work for Palestinian enterprises – and then: Corona.

While the virus may have forced the project to adjust the activities and its plans, it has not stopped the commitment to the cause, which has shown to be more important than ever given the current circumstances. The need for innovative technological business models that replace cash and mobility has become without a doubt particularly urgent. Moreover, alternatives to credit, which we refer here as alternative financing options, including insurance and peer-lending solutions are going to be crucial to strengthen resilience and provide financial support. Especially when the expected economic recessions hits or when the next Covid-19 wave and restrictions arrive.

A-FIN builds on the already established relationship with the Palestinian regulatory authorities – the Palestine Monetary Authority (PMA) and the Palestinian Capital Market Authority (PCMA) – through GIZ support since 2012 and under the regional project “Financial Inclusion in the MENA Region (FIMENA)”. The project aims to strengthen the framework conditions for innovative financial services by supporting the PMA and the PCMA in their role as Fintech promoters and enabling regulators as well as in their efforts to create trust in alternative and digital financing options. The next phase of the project, whose start is planned in 2021, is going to add a complementary dimension with the objective to facilitate the development and piloting of innovative financial solutions in Palestine.

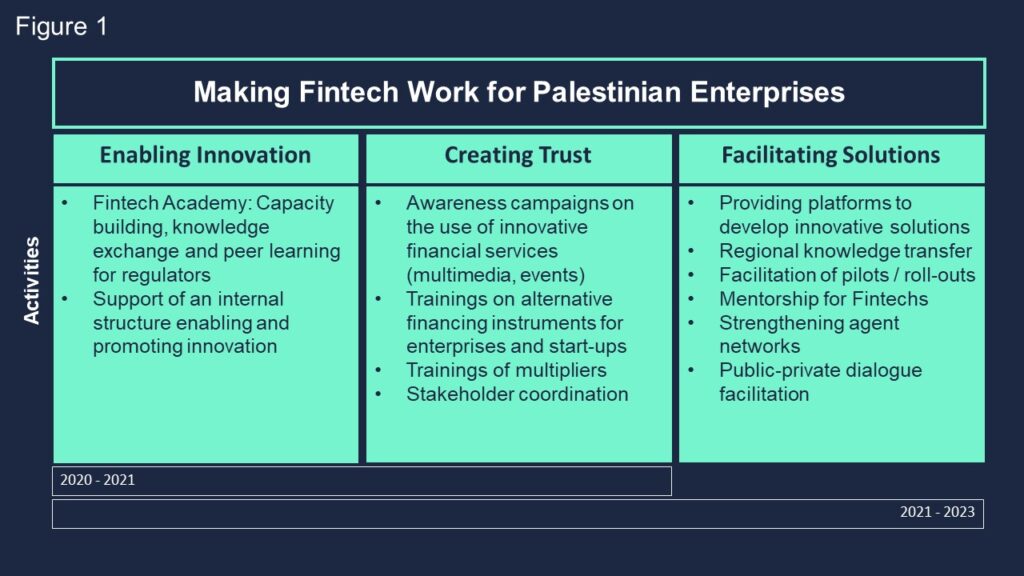

What does that mean in practice? Figure 1 illustrates the three activity pillars supporting the project’s objective and its elaboration can be found below.

Enabling Innovation

In times of rapid technological change, the regulatory authorities must be prepared for new Fintech and business providers to ensure the right balance between responsible innovation for financial inclusion and a safe and sound financial sector. Therefore, A-FIN designed a capacity building training program for the Palestinian regulatory authorities: The “Fintech Academy”. The Academy’s objective is to build Fintech capabilities and structures within the authorities to ensure proper evaluation and enabling Fintech regulation as well as the facilitation of controlled market entries.

Throughout 2020, twenty-one regulators have been successfully onboarded in the Fintech Academy and have participated in several webinars and online courses. Starting with Fintech foundations, the participants have had the chance to learn about basic concepts and theories in digital finance, digital payments and ecosystems, basics of peer-to-peer lending and crowdfunding solutions as well as about how to properly regulate and assess the risk of new technology solutions. While the Fintech Academy activities of this year have been limited to online formats and exchanges, the project is hoping for a more positive and mobile 2021 to provide complementary peer-to-peer exchanges and study visits to Fintech leading economies and regulatory authorities. The Academy will also provide next year further advanced courses and the opportunity to the participants to dive deeper into learned concepts and explore them with a practice-oriented approach.

Studying good practices and regional approaches with help of literature including GIZ’s “Fintech Toolkit” and the paper “Approach for Digital Financial Transformation in the Arab Region”, supported the establishment of the new innovation and Fintech promotion structures within the regulatory authorities. A-FIN accompanied these efforts with complementary advisory support and trainings. These new structures aim to improve coordination with the private sector and other stakeholders to address technological challenges and promote innovation. The project furthermore supports efforts to promote public-private exchanges and dialogues.

Creating Trust

In Palestine lack of trust in traditional financial services as well as low levels of financial literacy and financial awareness contribute to a high level of financial exclusion, reaching 64% in 2017.[2] A-FIN is therefore supporting the PMA and PCMA in their efforts to raise awareness on innovative and alternative financing options in an easy to understand and transparent manner. Social media campaigns and a broad set of multimedia materials including TV and radio spots, banners and videos will contribute to familiarize SMEs and individuals with available products, their benefits and risks as well as the technologies behind them. The latter shall build trust on the new services and encourage new users to handle them responsibly.

For the more specific demand and interests of SMEs, entrepreneurs and start-ups, A-FIN is planning to support the provision of additional and costume-made events and trainings targeting their specific informational needs and interests. Lastly, to make sure that the awareness is being broadly raised and to reach as many people as possible, the project will train key stakeholders such as universities, initiatives supporting start-ups (like incubators and accelerators), chambers, journalists etc. on innovative financing options so they can share information and serve as knowledge multipliers.

Facilitating Solutions

If the regulatory framework conditions are enabling innovation in finance and new services are trusted by SMEs and individuals, what else needs to be done to achieve our project objective?

While electronic and mobile payments services are permitted and available in Palestine since April 2020, their “use case” potential to facilitate all kind of payments including personal, governmental, social or salary transfers hasn’t been fully exploited yet. In addition, there is an endless number of Fintech solutions for insurance, lending and crowdfunding, remittances and finance management matters, to only name a few, that could be developed in Palestine or provided by Fintech businesses from the region. Therefore, in its next phase A-FIN is aiming to provide this missing piece by facilitating on the one hand the development or market entry of innovative and alternative financing options and on the other hand promising “use cases”.

To do so A-FIN is planning to provide the necessary platforms to crowdsource ideas from Palestine and beyond to tackle specific challenges and facilitate the development of tailored made innovative Fintech solutions. Creating new pathways for Fintech innovators and providers, the project is also going to promote regional knowledge transfer, offer mentorship and support the facilitation of business pilots.

With a bag full of activities and plans, the A-FIN project remains optimistic with the necessary level of flexibility when it comes to what 2021 might bring. More aware than ever how uncertainty times can be, one certainty remains: to make Fintech work for Palestinian enterprises.

By Sofia Bublatzky

References:

[1] Raed W. Rajab (2015): Assessment of Palestinian Policies to Facilitate Access to Finance for MSMEs. Available at: https://pfesp.ps/uploads/Assessment_of_Palestinian_Policies_to_Facilitate.pdf

[2] Palestine Monetary Authority (PMA) & Palestinian Captial Market Authority (PCMA) (2017): Financial Inclusion Study in Palestine. Available at: http://fsd-mena.org/wp-content/uploads/2019/01/FI-Study-Summary_en-1.pdf