Digital financial services play a key role in mitigating the economic impacts from the health crisis, in the recovery from lockdowns, and in maintaining social cohesion during and beyond the pandemic. Leading policymakers and regulators from the Arab world have acted quickly to put forward a joint framework for pro-actively steering the digital transformation in finance. Arab countries are set to enable their communities and businesses benefit from a wider set of inclusive, resilient Fintech-driven services for the recovery to come.

Covid-19 response and digital finance

The health challenges of Covid-19 and the political, economic and social consequences constrain governments, industries, companies and populations at unprecedented levels. The financial systems play a key role for countries coping with the pandemic in maintaining social cohesion and economic resilience. Digital financial services offer solutions for the fast, transparent and safe implementation of emergency aid, economic stimulus or social programs – for the direct support of businesses and societies.

For example, digital financial services were used in a number of countries to mitigate the effects of the pandemic. Digital payments can play a valuable role as a channel to deliver emergency cash relief to people, to deliver salaries to frontline workers, or to deliver stimulus support to businesses. Digital finance allows people to effectively send remittances to loved ones in remote areas or across borders. Digital payments reduce the risk of transmission of Covid-19 by allowing contactless payments and reducing the need for physical travel.

Supporting a robust and inclusive digital financial system is an important way through which countries can protect themselves against shocks and also create the foundations for development gains across sectors (such as health, agriculture and services) on the path to digital economies.

Building and rebuilding better financial systems: prospects for digitalization in finance in the Arab world

The digitalization in finance however brings about transformative changes with positive and negative effects, likely even more in the high-potential markets of the Arab region.

Up-to-date policies, rules, and development approaches that take into account the new chances and new risks in technology and digitization in finance are required to unlock the full potential of digital financial systems that benefit people and businesses.

Policymakers, industry executives, investors, and academic and development experts across the region are more and more dealing with the digital transformation in the financial sector more than ever before: so that the private sector (banks and non-banks) can meet the challenges of the digital age; communities can secure their livelihoods and companies can secure decent employment and growth. In short: the seeds for the digital future of financial systems ought to be laid today so that economic sectors and societies can grow stronger out of the crisis.

Central Banks join forces for the digitization of financial systems

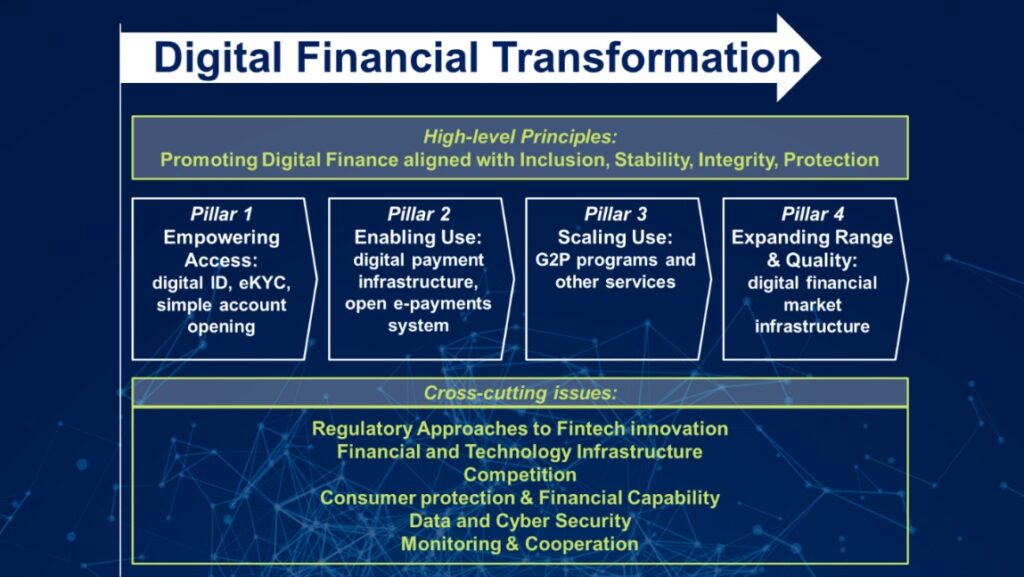

The Financial Inclusion for the Arab Region Initiative (FIARI) by Arab Monetary Fund (AMF), GIZ, World Bank and AFI empowers policymakers and regulators in making safe financial systems work inclusively for Arab societies. In a series of Covid-19 Response Consultations by the Initiative, central banks and other monetary and regulatory authorities from the region expressed the digital transformation of financial systems as their highest priority for the response and recovery from the crisis. The authorities developed a joint approach for digital transformation in the financial sector that takes into account the specific needs and requirements of the Arab world.

The guidelines were designed in alignment with the priorities of the Global Partnership for Financial Inclusion led by Saudi Arabia in 2020, and can support in-country efforts in the digital financial inclusion of youth, women and small and medium businesses. The digital financial transformation framework was adopted by the Arab Central Bank Governors in September 2020.

The regional framework provides valuable orientation for progressive policies in the countries in order to shape the digital transformation in the financial systems pro-actively and sustainably: from the on-boarding of people and businesses into the digital financial ecosystem, over electronic government services, to expanding the infrastructure quality and range of services. The framework offers strategic options for actions and sufficient flexibility for countries to sequence innovations relevant for their context (e.g. sovereign digital currency). Recommendations point to the sustainable design of the digital transformation process and cover: progressive rules, cooperation with public and private sectors, customer protection and literacy in the population, digital infrastructure, competition, as well as data and cyber security.

By Habib Attia, AMF & Atilla Yücel, GIZ

Further information:

Approach for Digital Financial Transformation in the Arab World

Fintech Toolkit: Smart Regulatory and Market Approaches to Financial Technology Innovation