In the aftermath of the COVID-19 pandemic and the subsequent recession, tackling climate change had taken a backseat. We have seen some initiatives for green recovery; however, they are far from universal. While countries such as Morocco and Egypt are already on the path of greening their financial systems, the pace is uneven across the region. Integrating sustainability into credit guarantee institutions (CGIs) and thus bringing it to smaller enterprises (SMEs) requires sustained efforts. During the EMGN Spring Academy 2022, we at GIZ’s Regional Project on Financial Inclusion in the MENA region (FIMENA) attempted to lay the foundation for the green transformation.

The EMGN Academy is peer to peer learning exchange platform for the Euro-Mediterranean Credit Guarantee Network (EMGN). It is promoted and supported by the Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ), along with the Euro-Mediterranean Economists Association (EMEA), and the European Institute of the Mediterranean (IEMED). This year’s EMGN Spring Academy was co-hosted by the Global Network of Guarantee Institutions (GNGI). It revolved around the topic ‘Greening CGIs in the MENA region’ with experts from various influential organisations.

Quick climate facts

Why climate change is a problem and what does it mean for the countries in the MENA region?

The current projections by the Intergovernmental Panel on Climate Change (IPCC) show that by the end of the century, the expected rise in temperatures is 4-5 degree Celsius. The expected variations and seasonal extremities would render the MENA region practically uninhabitable. This would adversely affect sectors such as construction, agriculture, and fisheries. The MENA region also happens to be most water stressed region in the world. By 2030 freshwater reserves and retention are expected to decline by an additional 20%.

The Climate Change 2022 Assessment Report by the IPCC has made it clear that anthropological climate change is real. The call for climate action has never been clearer or more urgent.

One of the speakers at the Spring Academy, Ms. Carol Chouchani Cherfane, the Director of the Arab Centre for Climate Change Policies at the UN ESCWA further pointed out that in spite this, the flow of official developmental assistance for enhancing adaptive capacities, in the MENA region and particularly in the Arab LDCs remains woefully low. The six Arab LDCs received only 5% of the total ODA commitment, of which only 18% was allocated for improving adaptive capacities. More climate change related data and analysis can be found at https://www.riccar.org/.

What is green finance? How does it differ from sustainable finance?

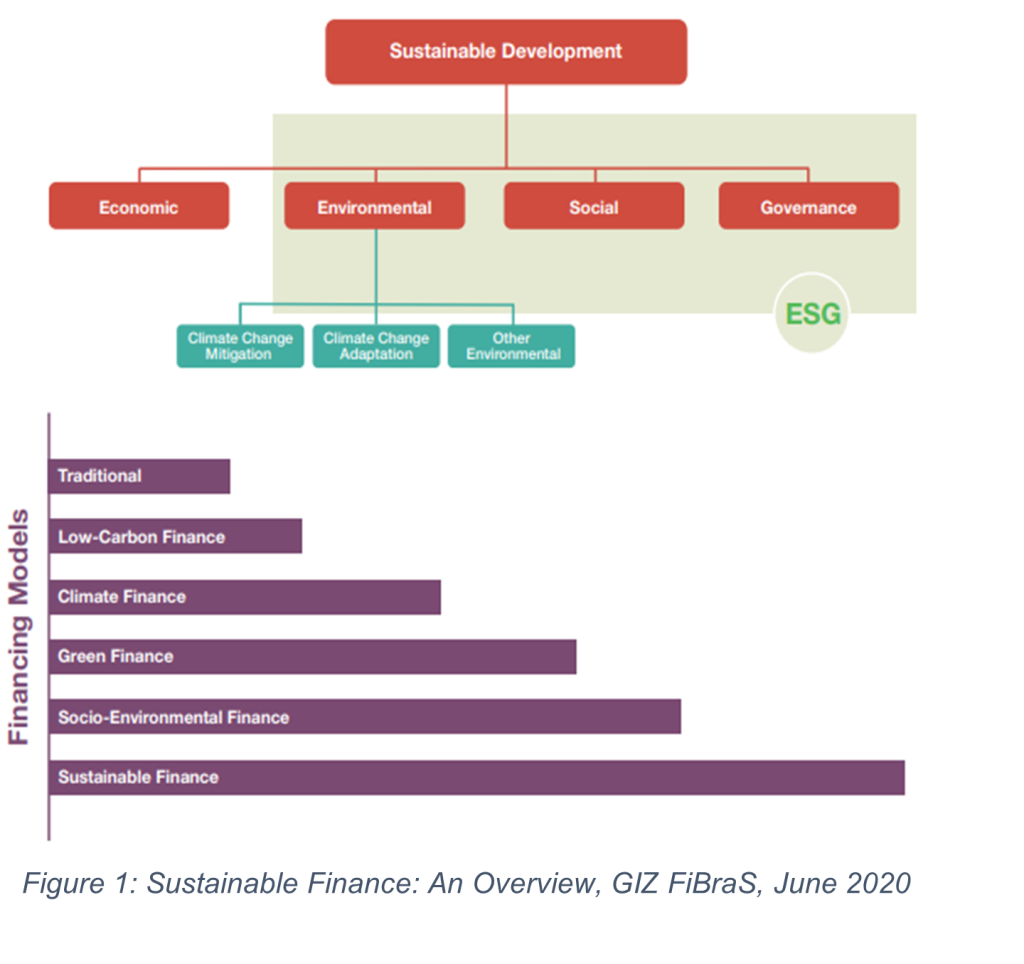

As per Mr. Achim Deuchert, Green Finance Advisor at GIZ, there is no single universal definition for green or sustainable finance and clarified some basic green and sustainable finance terminology using Figure 1. Green finance covers investments in projects and activities not just in climate adaptation or mitigation but also other environmental aspects such as biodiversity and nature. On the other hand, sustainable finance covers investments in other ESG (Environment, Social, and Governance) aspects, e.g., social (jobs, communities, etc.) and governance (transparency, anti-corruption, etc.), in addition to just environmental concerns.

As per Mr. Achim Deuchert, Green Finance Advisor at GIZ, there is no single universal definition for green or sustainable finance and clarified some basic green and sustainable finance terminology using Figure 1. Green finance covers investments in projects and activities not just in climate adaptation or mitigation but also other environmental aspects such as biodiversity and nature. On the other hand, sustainable finance covers investments in other ESG (Environment, Social, and Governance) aspects, e.g., social (jobs, communities, etc.) and governance (transparency, anti-corruption, etc.), in addition to just environmental concerns.

Why should CGS institutions act?

Mr. Pietro Calice, Senior Financial Economist at the World Bank Group propounded four dimensions that encourage CGS action:

Risk related aspects – climate risk related aspects are increasingly determining risk scoring and analysis. Even though current system of credit rating in the MENA region does not include ESG aspects, the vulnerability of specific industries and SMEs to climate disasters and occurrences needs to be considered when evaluating them for guarantees.

Interest from SMEs – frontrunner SMEs that are involved in the field would have specific requirements and unique risks that require dedicated interest from CGS for comprehensive guarantee-coverage.

Impetus from policy makers – the world is steadily moving towards net-zero climate emission goals. However, policy landscape evolves slowly and should be a motivating factor rather than a constraining one.

Attracting donors and working with other banks and financial institutions (FIs) – international funds, and donor agencies as well as banks and FIs are increasingly adopting aspects of ESG or signing onto net-zero alliances. It is likely that they would continue working with institutions that share similar strategic goals and risk outlook.

Ms. Nagla Bahr, Managing Director of Credit Guarantee Company of Egypt, stated that designing goals for green and sustainable transition is “no longer an option. The question now is not doing or not doing but rather ‘How to do it?’”

What can CG institutions do?

Mr. Calice further proposed three spheres of action for CGIs:

Policy and structural changes:

-

- Include components of the national sustainable finance strategy and references to Nationally Determined Contributions (NDCs) as per the Paris Agreement in their strategies

- Aligning internal strategies with climate goals such as the UN Sustainable Development Goals (UN SDGs)

The World Bank Group is working on a Guidance Note complementing their Principles for the Design of PCGSs, which may help CGSs work in the same direction,

Build CGS capacities:

-

- Identifying a couple of areas in the CGS to work on green and sustainable finance

- Launch pilots and understand what works in sector and country specific scenarios. Present results to funders

Constrained by current macro-economic conditions, transforming CGS may be a slow sector by sector process.

Awareness raising:

-

- Presenting green finance as a possibility and publicising successful business cases

- Compiling lists of other state resources available for SMEs beyond credit

What are the Challenges?

In a fishbowl discussion during the Academy with Ms. Maja Tomanič-Vidovič, Director at Slovene Enterprise Fund; Ms. Nagla Bahr, Managing Director of CGC Egypt; and Ms. Beatriz Freitas, Chairwoman of Banco Português de Fomento (BPF), the moderator Ms. Lucia Cusmano, Senior economist, SMEs and Local Development at OECD posed the question on the outlook and challenges for CGS. Below are some of them:

Increasing demand from SMEs – public CGS institutions are limited by their developmental mandate, most of their programmes focus on extending guarantees to SMEs / persons with no access to mainstream credit. The public mandate further implies discounted rates in comparison to the market. The CGS would have to rely on other regulatory and fiscal schemes that incentivise the green transition.

An understanding of existing market practices and benchmarking – green finance is still a new area for many CGS in the MENA region. More and detailed information regarding existing schemes and outcomes as well as frontrunner schemes is needed. The World Bank Group is currently working on a survey of existing market practices to analyse gaps in the region.

Limited material incentives – Regular Credit rating does not incorporate ESG aspects, which makes it difficult for CGS to incentivise green projects on their end.

Simpler policies and taxonomies – Ms. Tomanič-Vidovič underlined that though regulations and legislations like the EU taxonomy can provide positive motivation and are comprehensive in their coverage, they may be too complicated for individual CGS to decode alone.

Creation of a counter-guarantee institution

A further challenge was the structural and risk-related issue faced by the CGSs due to the absence of a counter-guarantee institution. Such an institution is common in matured markets as they act as a support structure allowing CGS to increase their capacities and insuring them against a possible collapse, e.g., Fundo de Contragarantia Mútuo (FCGM) in Portugal, and ARIZ– risk sharing of the French Development Agency (AfD). As most CGS in the MENA region are at least partly owned by the state, a regional counter-guarantee institution would fit better in terms of risk sharing.

A special working group was set up by the EMGN to explore opportunities for setting up a regional credit guarantee scheme. This working group, which included experts from the Landt Group conducted a series of workshops on creation and structuring of such an institution and shared case studies of salient institutions in other countries.

Whereas financial inclusion has come a long albeit incomplete way in the MENA region, green finance is still catching up. With the COP27 being hosted in Sharm el-Sheikh, Egypt this year, the region is experiencing a refreshing increase in interest in green and sustainable finance. CGSs are constrained by their mandates but are also in touch with the small and medium enterprises (SMEs). Although SMEs do not have the biggest environmental footprint, they drive innovation and demand for guarantees. As the green transition takes place, CGSs need to be ready with the strategic and policy groundwork.

In this context, GIZ is strongly committed to contributing to the green finance transformation. This is evidenced by similar projects in Brazil, Bangladesh, and other parts of the world. GIZ’s efforts in green and sustainable finance are guided by the German Sustainable Finance strategy which prioritises supporting embedding of sustainability in financial markets in its partner countries.

By Anusha Nayak