Only 33 percent of adults in Jordan, 27 percent of women, has an account with a financial institution, while 38 percent is completely excluded from the formal financial system according to a new study mandated by the Central Bank of Jordan (CBJ) in cooperation with GIZ. Access to finance in Jordan has shown improvements overall in recent years, but variations in financial inclusion across segments point to remaining disparities for the majority of the population, particularly for vulnerable groups such as the youth, women, refugees, and low-income segments.

Greater access to finance stimulates inclusive economic growth and employment, promotes social well-being, reduces socio-economic inequalities, and contributes to financial stability. Financial inclusion empowers the unbanked and financially under-served segments to contribute to and benefit from achievements in sustainable development.

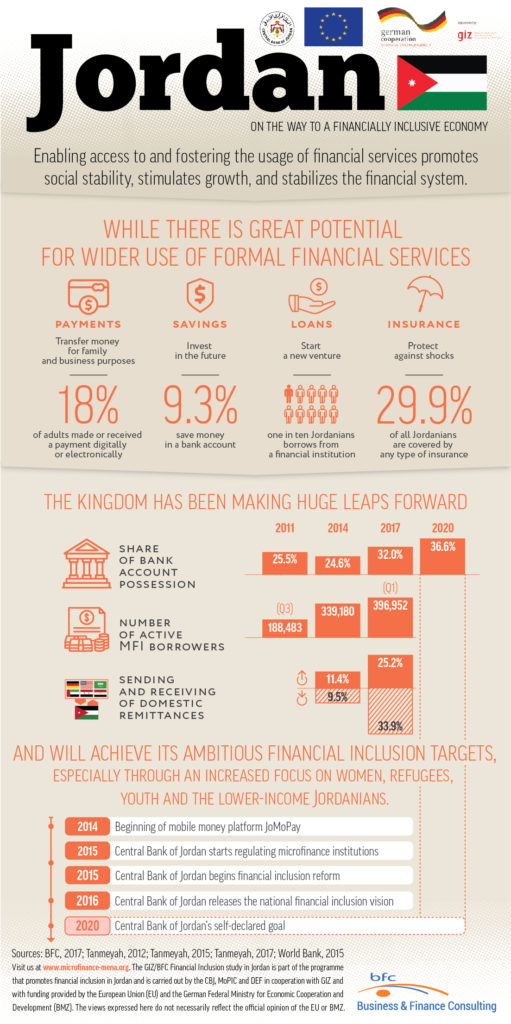

According to the share of adults with a bank account or mobile money wallet, the indicator that is widely used to describe the access to the formal financial system, the level of financial inclusion in Jordan has increased from 24.6% in 2014 (Global Findex) to 33.1% in 2017. Account ownership is an important indicator, as it makes possible the usage of other services such as debit cards, money transfers, overdrafts, and online payments.

Different segments of the population have varied access to financial services and particularly vulnerable groups continue to be considerably disadvantaged. The gender gap is still persistent as women (27.2%) are much less likely than men (37.6%) to have an account at a financial institution. Similarly, young people (aged 18-24; 23.6%) are less likely to have an account than older people (aged 25+; 38.6%). Members of the low-income group have far fewer accounts than those with high-paying jobs (bottom 40% vs. top 60% in terms of income; 19.3% and 43.7%, respectively). Non-Jordanians (9.5%) own accounts to a substantially lesser degree than their Jordanian fellow citizens (43.6%).

Key highlights of the 2017 demand survey are the finding that 62.0% of adults aged 15 and above, the range in age that is internationally used for comparison, used some form of formal financial service at least once in the past year, across various product categories including credit, deposits, remittances, payments, and insurance. On the contrary, 38.0% of adults were effectively excluded from formal financial services and 24.8% of adults did neither use formal nor informal financial services, such as borrowing from friends and relatives.

Only 6.8% of adults received their wages into an account and only 5.8 % of people did so for government transfers, leaving considerable potential for the digitalization of Business-to-Person and Government-to-Person transfers through bank accounts or mobile wallets. Particularly the latter has proven in other emerging markets to speed up financial inclusion of people and businesses noticeably.

The proportion of adults that saved money in an account increased to 9.3% in 2017. Nevertheless, more people save money informally, such as at home in cash, than in a bank account. Access to and quality of savings products still bears potential. Only about 28% of adults with an account use it to save money.

The proportion of adults that borrowed from a formal financial institution, such as a bank or microfinance institution, decreased from 13.6% in 2014 to 9.9% in 2017. Notably, more people (13.3%) borrow from informal sources, such as family, friends and employers, than from formal financial institutions. Meanwhile, MFIs have continued to serve an ever growing number of people, counting 397,000 active borrowers, two thirds being women, in 2017.

The usage of remittance services to send and receive money domestically, through formal and informal channels such as in cash, has grown between 2014 and 2017 (see chart).

The current study is one of the first to take a comprehensive look at financial inclusion among non-Jordanian citizens living in Jordan. Foreign citizens tend to approach rather informal than formal sources for both borrowing (20.2% vs. 1.9%) and saving (9.8% vs. 3.9%). Compared to Jordanians, they more actively send or receive money through formal remittance channels.

Refugees, a particularly vulnerable sub-group, have even lower levels of financial inclusion (7.5% have an account and 1.5% borrowed formally), but more than half (50.2%) sent or received money through formal remittance channels in the past year.

The reasons for financial exclusion are multi-fold and rooted in different dimensions. For example, residents of rural areas (40.9%) find it rather difficult to reach a bank branch compared to urban residents (9.9%). The total number of bank branches per 100,000 adults of 13.9 puts Jordan roughly in the middle of other Arab countries. In terms of quality, half of adults without an account (47.4%) are often discouraged by the product conditions, with high account fees and high minimum balance requirements being of greatest concern.

The Central Bank of Jordan embarked on a national, multi-stakeholder policy process for enhancing the formal financial inclusion of the entire population, mainly among the youth, women, refugees, low-income segments and micro, small and medium-sized enterprises, in order to unleash economic and social development potentials.

The supply-side analysis of financial industries and the demand survey of 1,000 individuals, carried out by BFC consulting, informs about the access, usage and quality specifics in financial services. It will enable the CBJ and all relevant stakeholders to bring to life evidence-based financial sector policies and reforms for enhancing financial inclusion in Jordan.

The 2017 study of financial inclusion in Jordan was commissioned by Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH in support of the Government of Jordan for the Promotion of Financial Inclusion in Jordan, a programme that is carried out with funding from the European Union and the German Federal Ministry for Economic Cooperation and Development (BMZ).

The CBJ and GIZ – Amman, October 9, 2017