In an effort to promote the Egyptian micro, small and medium-sized enterprise (MSME) sector, the Central Bank of Egypt (CBE) has issued a new definition for MSMEs aiming to foster data quality and promote bank lending to this client segment.

On the third of December 2015, the CBE has issued a decree including a new definition for MSMEs. In doing so, the CBE caters to unify the varying definitions used by the banks in Egypt for the sake of more accurate and complete data about this particular segment of enterprises.

At the same time, the CBE encourages banks to pay more attention to the MSME sector. It stresses the further development of the MSME financing departments by setting up adequate policies and procedures alongside collecting sufficient data in order to develop progressive rating systems customized for this category of clients

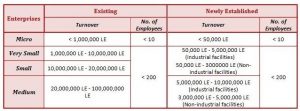

The following table summarizes the new definition of MSMEs:

As a bolster for the CBE’s new move, some amendments have been adopted on the existing regulatory instructions governing bank lending. The new amendments cover the evaluation of the creditworthiness of customers and the rules of regulating the credit registry systems. To ensure the effectiveness of the new decree, the CBE has granted the banks until mid-2016 to adjust their positions according to the new amendments.

By Basem Elsebaie